PayThisWay - The all-in-one solution for the Payments 4.X era

Open banking, account-to-account payments (A2A), and customer experience-driven solutions are the global megatrends on the way to the Payment 4.X era. Be ready for the payment future with PayThisWay powered by Deutsche Payment - today.

Your benefits

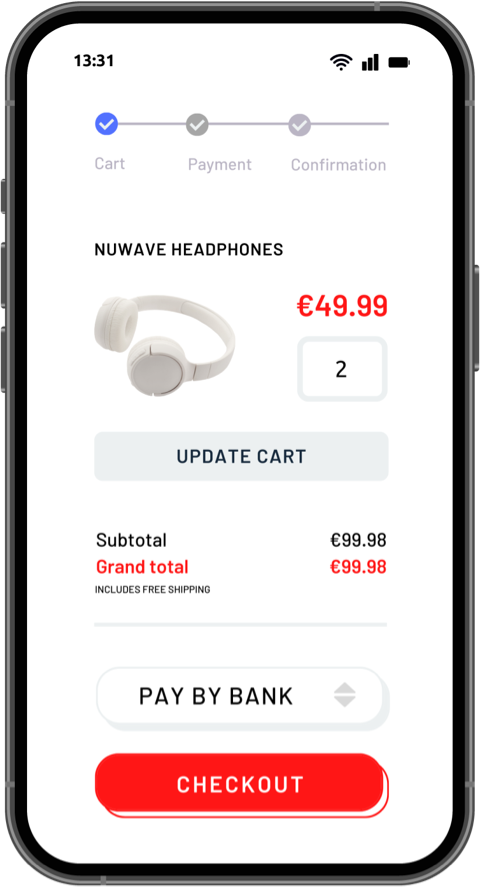

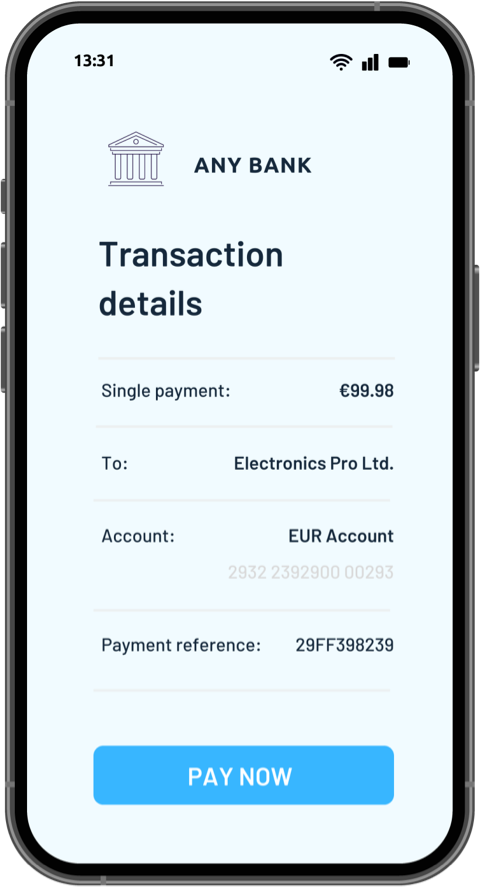

Fast and frictionless payments

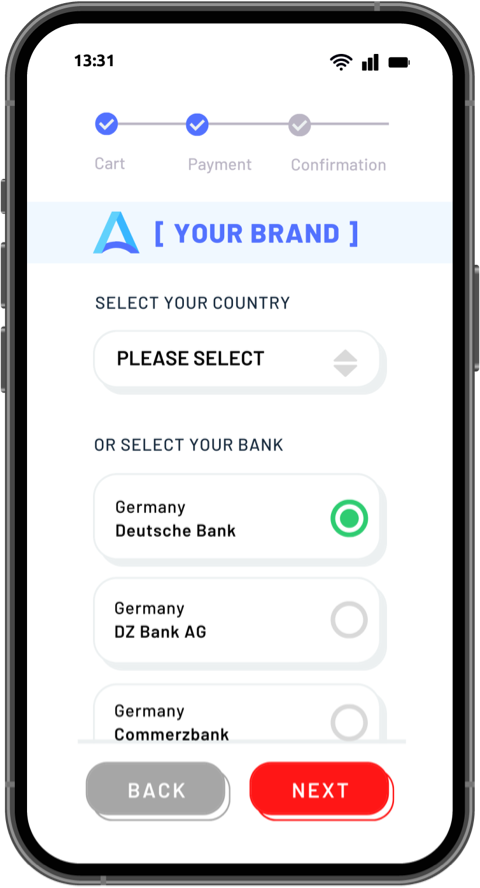

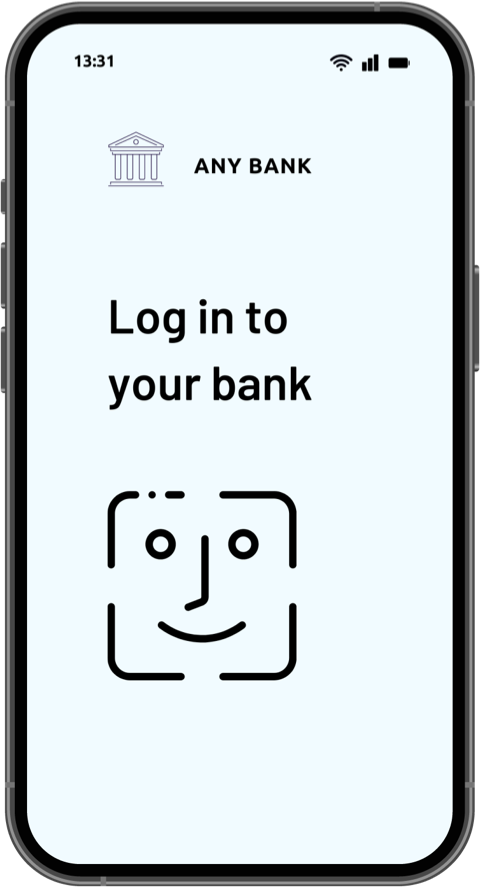

Your customers benefit from one-click payments. App-to-app redirecting to your customers’ mobile banking app replaces time-consuming and cumbersome manual data entry.

PayThisWay also impresses with extremely high availability rates (almost 100%) and fast response times in the millisecond range, all of which positively influence the customer experience.

Cost efficiency

High costs are a thing of the past with PayThisWay. The costs per transaction are 2 – 20 times lower with PayThisWay compared to traditional payment methods, regardless of the payment amount. Costs for card schemes, processing, chargebacks, and compliance are eliminated as well.

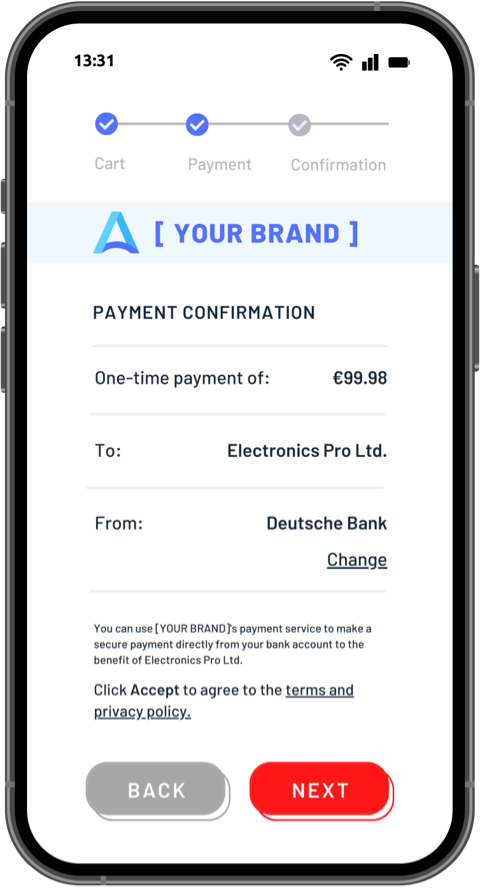

Security

As with all our solutions, security is central to PayThisWay. PayThisWay is 100% API-based, PCI-DSS Level 1 certified, and PSD2 compliant. You don’t have to share or store your customers’ card data.

Customization

With PayThisWay, you can design the customer journey consistently and create another touchpoint with your brand when customers pay. Therefore, you have various options to design the user interfaces (including colors, logos, button labels, etc.) individually and according to your corporate identity.

Are you ready for the

payment future?

PayThisLater - Your solution for Buy Now, Pay Later (BNPL)

Regardless of whether purchase on account, installment payment, or lease-to-own - with PayThisLater, you can offer your customers maximum flexibility for payments at a later date.

Your benefits

Optimal Checkouts

A single BNPL payment button at the checkout and only one single credit application increase customer experience and reduce purchase abandonments.

Simplicity

You only need one API to gain access to 70+ BNPL providers (220+ by the end of 2023). This means that only a single contract is required and integration is one-time for all providers. Integration costs are thus up to 40% lower.

Larger Limits

Your customers benefit from higher limits of up to $20,000 depending on customer worthiness, which, in turn, increases average tickets and sales.

Higher Performance

Increase conversion rates by up to 30% and credit approval rates by up to 85%. In addition, PayThisLater allows access to providers of all risk levels.

Up to date

Don't miss the latest news, insights, and announcements.

Information & knowledge

Get informed about innovations in payments.